by Katherine Preston

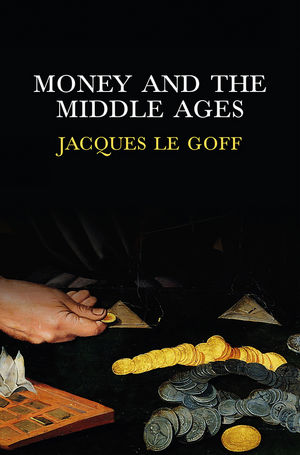

Published by Polity, 2012 | 200 pages

Justin Welby, a former oil industry executive and now Archbishop of Canterbury, created a stir in July 2013 when he told Errol Damelin, the founder and chief executive of payday-lender, Wonga: “we’re not in the business of trying to legislate you out of existence, we’re trying to compete you out of existence.” Welby’s public challenge to big pay-day lenders – accused of manipulating and exploiting the vulnerable – was part of his initiation of a Church of England staff credit union designed to provide loans at favourable rates. Though certain religious factions these days, especially in the States and the UK, may no longer consider caring for the poor one of the higher callings, Welby’s efforts are in fact one recent example in the long history of attempts to assert the ethical (and in this case religious) dimension into the economic and financial systems. While the religious dimension of this argument may be unsettling or even controversial to many people, there is no doubt that putting public interest at the heart of financial planning is a welcome suggestion. But are these juxtapositions of religion and finance, ethics and profit beneficial? Too black and white? Innovative? Are they… medieval?

The focus of Jacques Le Goff’s tour de force Money and the Middle Ages is on a period of history (predominantly 12-15C Western Europe) that, in financial terms at least, comprises an alternate universe to a modern capitalist economy. Le Goff, a cultural historian, reiterates throughout that ‘capitalism was not born in the Middle Ages, and that the Middle Ages was not even a pre-capitalist age’ (italics mine), but rather an entirely distinct culture and society. For example, certain preconditions for capitalism to be realised – such as currency and a unified market – are anachronisms in the Middle Ages, where paper money was not yet used, precious metals for minting coins were often in significant shortage, and markets were fragmented. What we have instead are “medieval economies”, huge numbers of different currencies and schemes of payment, including gift-exchange and rewards for labour. At the centre of these economics, indeed at the center of all Medieval Culture, the Christian Church still largely determined the distribution and economic order and flow of wealth through its legislation, teaching and morals.

Le Goff’s Money and the Middle Ages is an analysis of the medieval perception of money, as well as the Church’s mentalité on it. He traces, in a roughly chronological narrative, the Church’s multifarious interventions, adaptations and regulations, in direct response to issues that arose concerning the economy and the subject of money. These included: the subject of usury (profiting by lending money, goods, land, time or knowledge), taxation, the changing role of Kings and Empire, war and ransoms, building and renovation as costly markers of cultural prestige, and the position of the merchant in society.

Though Le Goff insists on the fundamental gap between Medieval and Modern conceptions of money, it if of course not the case that there are zero hints at emergent capitalist tendencies in this period. These include the increasing awareness in the twelfth century of the value of time for labourers in towns and the birth of the notion that time is money; also, the emergence of taxation alongside developments in law and government, which often showed itself to be poorly regulated, ineffective and capable of sparking revolt among the poor (who were hit the hardest by it); and furthermore, the origins of banks and, unsurprisingly, the first instances and catastrophic consequences of bankruptcy, resulting from rash and overly ambitious lending.

At times, Le Goff seems to promote secular markets, and portrays the Church as retarding innovations in the market. His text explores how the Church utilised religion to advance its own ambitions of wealth, including its financial gain and its ability to exercise power across all aspects of medieval society. ‘We see,’ he writes, ‘how money motivated the papacy to maintain a misleading image of religious… crusades and heresies persisted in the Christian imagination in order to satisfy the financial appetites of the Church.’

At other times, however, Le Goff shows himself sympathetic to the Church’s efforts. The Middle Ages, for example, saw first steps towards legislation and regulation to curb economic injustice, (proto)market monopolisation, etc., steps largely initiated by the Church. The Franciscans, and the Church more generally, had the authority and the social clout to pressure neglectful governments or monarchies, and insist on controlled prices for goods and minimum wages for poor labourers. For example, in the late fourteenth century, certain shifts in the ideas and practices of the Church meant that it lent social and spiritual support to the figure of the merchant, who it protected with laws and teachings to safeguard personal property and pursue just law and individual rights within the financial markets. In the fifteenth century, the Franciscans founded credit agencies intended to provide poor people with money to survive.

The subject of Money and the Middle Ages is, unsurprisingly, the Middle Ages, but it also has a very definite place within contemporary conversations. In presenting an alternative perception on money, it challenges the reader to consider how capitalism is a cultural construct and inheritance, and not a state of nature. Le Goff’s work impresses upon us the fact that the modern capitalist worldview is a recent development, and accordingly a legitimate subject of analysis and critique.

Jacques Le Goff, author of other highly influential works, such as The Medieval Imagination and The Birth of Purgatory, makes an important and refreshing contribution to medieval and contemporary studies, drawing on economic theory, cultural studies and in-depth historical research. His text, which traces leading arguments clearly throughout, and provides an extensive bibliography and list of recommended reading for anyone who wishes to explore individual topics in greater depth, is a very clear and authoritative analysis of the perception and use of money across three very turbulent centuries of western European history. Money and the Middle Ages ultimately joins its voice with other secular and religious calls for ethics to be placed at the heart of discussions on money matters today, on the subject of regulation within creative economies, as indeed public interests in business exchanges. It sets out a thought-provoking, competitive alternative perspective on money.

Rebecca Hardie is a PhD student at King’s College London. Her research focuses on translation cultures in early medieval religious prose, and asks about the implications of this on the history of subjectivity in the West.

click to see who

MAKE Magazine Publisher MAKE Literary Productions Managing Editor Chamandeep Bains Assistant Managing Editor and Web Editor Kenneth Guay Fiction Editor Kamilah Foreman Nonfiction Editor Jessica Anne Poetry Editor Joel Craig Intercambio Poetry Editor Daniel Borzutzky Intercambio Prose Editor Brenda Lozano Latin American Art Portfolio Editor Alejandro Almanza Pereda Reviews Editor Mark Molloy Portfolio Art Editor Sarah Kramer Creative Director Joshua Hauth, Hauthwares Webmaster Johnathan Crawford Proofreader/Copy Editor Sarah Kramer Associate Fiction Editors LC Fiore, Jim Kourlas, Kerstin Schaars Contributing Editors Kyle Beachy, Steffi Drewes, Katie Geha, Kathleen Rooney Social Media Coordinator Jennifer De Poorter

MAKE Literary Productions, NFP Co-directors, Sarah Dodson and Joel Craig